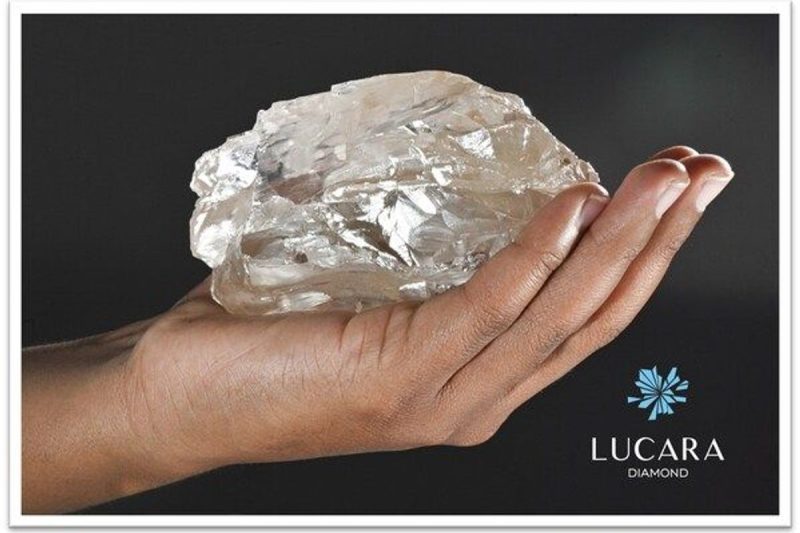

Lucara Diamond (TSX:LUC,OTC Pink:LUCRF) announced the discovery of an ‘epic’ 2,492 carat diamond at its Karowe mine in Botswana on Wednesday (August 21), saying it is one of the largest rough diamonds ever found.

Media reports indicate that it is second only to the 3,106 carat Cullinan diamond found in South Africa in 1905.

The site where the diamond was discovered is no stranger to producing large stones. Previous significant discoveries from Karowe include the 1,758 carat Sewelô and the 1,109 carat Lesedi La Rona diamonds.

The Sewelô diamond, discovered by Lucara in 2019, was eventually sold to luxury brand Louis Vuitton. Its unconventional black appearance made it difficult to determine its gem potential, and the selling price wasn’t disclosed.

At the time Sewelô was considered the world’s second largest diamond.

Prior to that, Lucara sold the Lesedi La Rona diamond to a British jeweler in 2017 for US$53 million. It was eventually cut into several high-quality diamonds, the largest of which weighed over 300 carats.

This latest find is expected to further solidify the Karowe mine’s reputation as one of the world’s most productive sources of large diamonds. While Lucara has not disclosed the value of the 2,492 carat stone, its size alone makes it historically significant and suggests that it could be worth tens of millions of dollars, particularly if it is of high gem quality.

“The ability to recover such a massive, high-quality stone intact demonstrates the effectiveness of our approach to diamond recovery and our commitment to maximizing value for our shareholders and stakeholders,’ said President and CEO William Lamb in the company’s press release, emphasizing the ongoing potential of Karowe.

On Thursday (August 22), Mokgweetsi Masisi, Botswana’s president, was among the first to see the diamond. Botswana is currently the leading diamond producer by value globally, second only to Russia in terms of overall production.

Lucara’s discovery comes at a time when the country is trying to ensure that more profits from diamond mining stay within its borders. Last month, Botswana’s government proposed a law requiring mining companies to sell a 24 percent stake in their operations to local investors unless the government itself decides to take the stake.

Furthermore, the country has been working to increase its influence in the industry, particularly through negotiations with De Beers, the world’s largest diamond producer, through a new 10 year agreement signed last year.

Lucara’s use of cutting-edge X-ray transmission technology has played a crucial role in its discoveries. Implemented in 2017, it allows for the detection of large, valuable stones during the recovery process, minimizing the risk of damage.

In the diamond industry, the value of a diamond is determined not just by size, but also by its color, clarity and the number of polished stones that can be cut from it.

For now, the company is withholding specifics regarding the potential for cutting the diamond into individual gems.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.