The International Energy Forum (IEF) has expressed strong support for the UK’s recent £21.7 billion commitment to fund two large-scale carbon capture projects in the country’s industrial heartlands.

The organization hailed the investment as a significant step forward in the global effort to reduce carbon emissions and develop clean energy technologies.

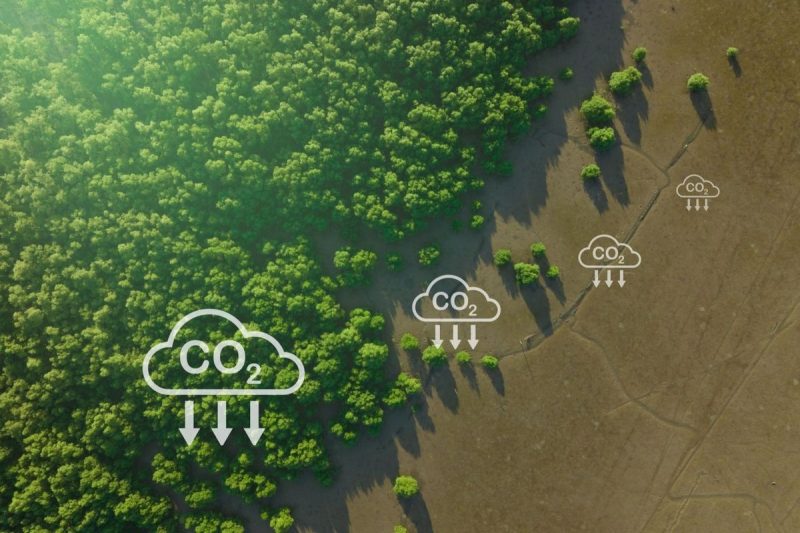

Carbon capture technology involves capturing CO2 emissions from industrial processes before they are released into the atmosphere and storing them securely underground.

The two UK-based projects are expected to capture more than 8.5 million metric tons of carbon dioxide (CO2) annually, which is equivalent to removing approximately four million cars from the road.

By deploying these clean technologies, industries in Northern England — including sectors like cement, steel and chemicals — will be able to significantly reduce their carbon footprints while maintaining their competitive edge.

The funding, which will be directed towards carbon capture and storage (CCS) sites in Merseyside and Teesside — both major hubs for energy-intensive manufacturing.

By investing in CCS, the UK aims to support the retention and creation of jobs in these regions while contributing to the national goal of reducing carbon emissions by 68 percent by 2030 and transitioning to a net-zero economy by 2050.

Joseph McMonigle, Secretary General of the IEF, applauded the UK’s decision as a bold move in the right direction.

“The UK’s commitment to supporting carbon capture and other low-carbon technologies will not only enhance its industrial competitiveness, but also set a global example for accelerating clean energy transitions,’ McMonigle said in an IEF statement on Monday, October 7.

According to McMonigle, scaling up this technology globally is essential to reaching the carbon reduction targets established by international climate agreements, such as the Paris Accord.

In 2021, the IEF released a report calling for the capture of 5.6 gigatons — 5.6 billion metric tons — of CO2 annually by 2050 to meet international climate and sustainable development goals.

In addition, the Carbon Management Challenge, launched last year, seeks to unite 20 countries in scaling up CCS capabilities, with a global storage target of 1 gigaton of CO2 per year by 2030.

Both the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) have identified CCS as a key technology in the fight against climate change.

The UK’s CCS capacity is significant, with enough geological storage to accommodate over 200 years of CO2 emissions.

As part of the funding initiative, the government is also investing in transportation and storage networks that will carry captured carbon to deep geological storage sites in the North Sea and Liverpool Bay.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.