President Donald Trump is pushing a new economic strategy: having the U.S. government take direct stakes in major U.S. companies. He argues it’s a way to make the country stronger by shoring up industries that fuel prosperity and safeguard national security.

The first big example came last week, when the White House announced the government now owns nearly 10% of Intel. The California-based chipmaker had received federal grants to boost U.S. production, but those funds have now been converted into a formal ownership share.

The U.S. government has historically offered loans, tax breaks, or contracts to private companies — but owning stock in them is much less common, raising questions about how far Trump’s approach might go and how Intel’s competitors may view the move.

One of those competitors, SkyWater Technology, a Minnesota-based semiconductor foundry with deep ties to the defense sector, welcomed the precedent while underscoring its all-American footprint.

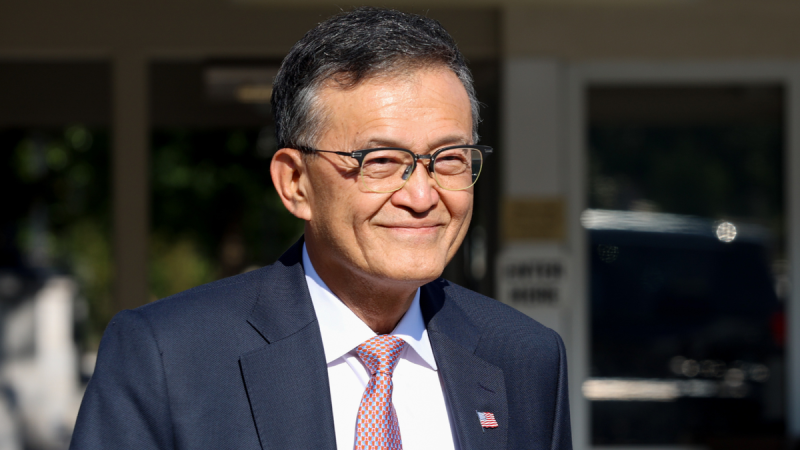

‘We view equity stakes as an important tool to ensure accountability when taxpayer dollars support companies whose global structures raise questions about long-term U.S. benefit,’ Ross Miller, SVP of Commercial and A&D Business, told Fox News Digital.

He contrasted that with SkyWater’s position as a fully domestic manufacturer: ‘SkyWater is different — we are U.S.-headquartered and U.S.-operated, with no foreign ownership or entanglements.’

‘Every dollar invested here directly strengthens America’s infrastructure, workforce, and independence,’ Miller added.

Looking ahead, he said SkyWater hopes to deepen collaboration with the Trump administration to expand domestic capacity in foundational chip technologies — the tried-and-true manufacturing methods that still power reliable systems in airplanes, automobiles, defense, biomedical equipment and even quantum computing.

SkyWater isn’t the only U.S. chipmaker that could be affected by Trump’s new approach. New York-based GlobalFoundries, a semiconductor manufacturer, operates large-scale chip fabs in New York and Vermont. Supported by federal funding, these sites play a central role in U.S. efforts to bring back more domestic chip production.

Given the firm’s federally-backed fabs on U.S. soil, GlobalFoundries could become a candidate for equity-linked deals tied to Trump’s semiconductor resilience goals.

Similarly, Micron Technology, which is investing tens of billions of dollars to build memory chip fabs in New York and Idaho with the support of CHIPS Act funding, could also fall under consideration. The Boise, Idaho-based company has positioned itself as a cornerstone of U.S. efforts to restore leadership in advanced memory manufacturing.

GlobalFoundries and Micron did not immediately respond to Fox News Digital’s request for comment.

On Monday, Trump suggested this was just the beginning. ‘I hope I’m going to have many more cases like it,’ he told reporters at the White House, hinting that his administration could pursue similar deals in other sectors.

But not everyone sees the move as positive.

‘This is bad policy and the most glaring example to date of the administration’s tilt towards socialism. It’s an unprecedented move, so I’m hesitant to make any predictions,’ explained Jai Kedia, a research fellow at the Cato Institute’s Center for Monetary and Financial Alternatives.

Kedia also warned the policy could display ‘favoritism towards large firms that can negotiate deals with the executive at the expense of small and mid-size firms that do not have the political clout to arrange such deals.’